Survival Is the Innovation

Why Bitcoin Refused Silicon Valley’s Playbook and is Outliving the Crypto Narrative

Crypto is not in a stalling period because it lacks innovation.

It is stalling because it misunderstood what kind of problem it is actually trying to solve.

The industry borrowed Silicon Valley’s laws and applied them to money.

But money is not software.

Software is only the vessel. Authority, trust, and time are the substance.

And not everything that compounds computes.

Every generation is tempted to confuse momentum with meaning.

Crypto often mistakes velocity for truth.

Bitcoin never did.

Recently, I read Jeff Park’s essay “In Defense of the Ideological,” and I keep coming back to one phrase that should haunt every builder, investor, and economist who still thinks crypto is just “tech, but faster.”

Bitcoin is not an exponential growth story.

Bitcoin is an “exponential loss” story as Jeff calls out and I have prophesizing.

Loss of trust.

Loss of credibility.

Loss of monetary integrity.

Loss of the illusion that someone in a committee room can fine tune human nature with interest rates.

That framing is a surgical strike. It explains why Bitcoin keeps surviving while so many Layer 1 dreams keep stalling.

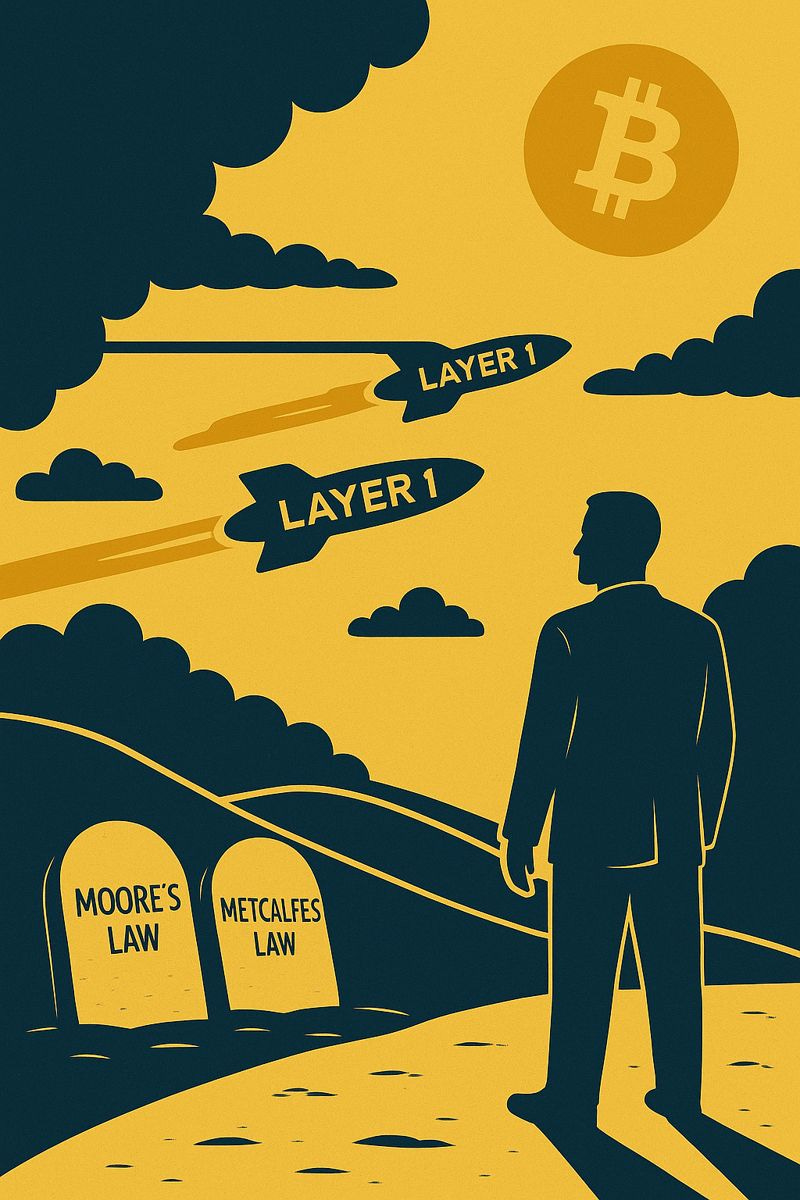

Crypto L1s tried to borrow Silicon Valley’s favorite bedtime stories. Moore’s Law. Metcalfe’s Law. Network effects. Winner take most. Just add a token and wait for the chart to go up.

Jeff Park’s point is that this lens misread the room. The wealth effect in L1s was often not compounding utility. It was incentives chasing incentives. Goodhart’s Law in a hoodie: when the metric becomes the target, the metric stops measuring anything real. TVL, active addresses, “ecosystem funds,” dev counts, DAU. These became props in a narrative war where capital was both the fuel and the applause.

Before going further, it helps to define the language that quietly shaped an entire decade of crypto thinking. Definitions (Plain Language)

Layer 1 (L1): A base blockchain network where transactions are settled directly. Examples include Bitcoin, Ethereum, and Solana.

Moore’s Law: The observation that computing power roughly doubles every two years, driving exponential improvements in technology.

Metcalfe’s Law: The idea that a network’s value grows proportionally to the square of its users, often used to justify winner-take-most platforms.

TVL (Total Value Locked): The total amount of capital deposited in a blockchain or protocol, often used as a proxy for “adoption.”

DAU (Daily Active Users): A measure of how many users interact with a platform each day, commonly used to signal engagement or growth.

Metrics are not truth. They are signals. And signals can be gamed.As someone who spent years supporting builders at AWS as I founded our crypto business, I recognize and lived the analogy he makes to cloud computing. If an L1 is supposed to be a settlement layer, then yes, it looks less like an internet bookstore and more like a marketplace for compute primitives. The uncomfortable truth is also familiar: most blockchain customers choose convenience over ideology. They do not wake up asking for decentralization. They wake up asking for something that works.

This is why many L1 token models created a quiet betrayal. They were pitched as equity like upside, but traded like FX like settlement chips. Securities when convenient. Not securities when inconvenient. Fees when it helps the story. Flows when it helps the chart. And retail was asked to hold the bag while corporations and centralized distribution captured the durable value.

That is not a dunk on innovation. I love builders and have supported them throughout my career. However, it is a reality check on value capture.

Bitcoin is different because it refused to play that game.

Bitcoin has no founder roadshow.

No token unlock calendar.

No foundation war chest to “incentivize” belief.

No governance theater where the loudest Discord wins.

Bitcoin does not ask you to trust a leader.

Bitcoin forces you to verify a system.

And that is why Jeff Park’s “knockout call option” critique lands so hard on L1s. If an L1’s ideological moat is fragile and binary, then success increases the probability of the knockout. The bigger it gets, the more it threatens incumbents, and the more likely it is to be contained, captured, or crushed. Partial decentralization becomes a marketing term. Credible neutrality becomes optional. And optional neutrality is just politics wearing a protocol hat.

Bitcoin is not “crypto” the way most people mean it.

Most crypto is an organization with a token.

Bitcoin is a protocol with no throne.

Most crypto has managers, cap tables, incentives, and governance levers.

Bitcoin has rules, difficulty, and time.

Most crypto can change monetary policy because a roadmap says so.

Bitcoin’s monetary policy is the point.

The Kingdom lens makes this even clearer.

In a world chasing tokens that promise kings, Bitcoin offers a different gospel of code: no throne, no founder, no bailout, just blocks, discipline, hard plain truth.

Scripture is relentlessly suspicious of false measures and concentrated control. God does not bless a system because it is clever. He blesses what is true.

Honest scales are His delight.

Truth in the inward parts is what He desires.

And when power centralizes, it tends to corrupt, then collapse.

Bitcoin, for all its imperfections as a human tool, is structurally aligned with something ancient: a fixed measure that does not respect persons, does not bend to threats, and does not change because the powerful prefer it.

This is why Bitcoin breaks traditional economists. They keep asking the wrong question.

They ask, “Where is the cash flow?”

Bitcoin asks, “Where is the integrity?”

They ask, “Who stands behind it?”

Bitcoin answers, “No one. That’s the feature.”

They ask, “What is the fundamental value?”

Bitcoin exposes the deeper fundamental: whether your measuring stick is honest.

And here is the part that will offend both maximalists and altcoin evangelists.

I still believe there is meaningful building to do across blockchains. Some experiments will matter. Some will unlock new financial substrates that change the world. Some will die, and that is okay. Innovation germinates in the ashes.

But I also believe this: when the world gets serious, it reaches for simplicity that does not negotiate. It reaches for a base layer that survives.

Bitcoin is the survivor. Not because it is flashy. Not because it promises a new app store every cycle. But because it kept showing up, block after block, through ridicule, bans, lawsuits, forks, and every fashionable obituary the internet could write.

That is not hype. That is endurance.

And endurance is often how God proves what is real.

Prayer

Father, give us discernment in an age of narratives and incentives. Teach us to love truth more than trends, and stewardship more than speculation. Where we have been seduced by convenience, bring us back to conviction. Where we have trusted in princes, bring us back to You. Lead builders to create what serves people, protects the vulnerable, and honors honest measures. And let Your Spirit guard our hearts so money never becomes our master, and bitcoin never becomes our idol. In Jesus’ name, Amen. 🙏🔥

👍👍

Powerful framing on Bitcoin as survival rather than disruption. The exponential loss angle is underrated, every fiat debasement cycle proves it without anyone having to shill it. Saw this in 2019 when corps were chasing "blockchain not bitcoin" then quietly pivoting once they realised trust cant be patched with better UX. Metrics like TVL always felt hollow compared to the unignorable uptime signal Bitcoin keeps broadcasting.