Four Part Series | Bitcoin in Context

Part 1: Setting the Table. Why “Money Printing” Is Not the Whole Story.

A four-part Kingdom Bitcoin series

Coming up in this series:

Part 1: Setting the Table. Why “money printing” is not the whole story.

Part 2: Two Bitcoins, One Network. Why bitcoin behaves differently in different seasons.

Part 3: Good Deflation, Bad Deflation, and the Awkward Middle.

Part 4: Credibility, the Federal Reserve, and the moment truth confronts pretense.Bitcoin is not broken. The way most people have been taught to think about bitcoin is. That distinction matters.

Over the past several weeks, I’ve had countless conversations that all circle the same question. If money is being printed, if debt is exploding, if the system feels stretched thin, why is bitcoin down? Why does it feel stuck? Why does the story no longer match the price?

I’ve lived through multiple cycles where the story and the price told very different truths. Those are honest questions. They deserve honest answers. The problem is not bitcoin. The problem is the story.

Most people were taught a very simple equation. Print money, currencies weaken, hard assets rise. That logic is not wrong. It is simply incomplete. And incomplete stories create confused expectations, especially when markets enter unfamiliar seasons.

Scripture reminds us that wisdom is the foundation, not simplicity. Wisdom sees layers. Wisdom resists slogans. Wisdom asks better questions before demanding fast answers.

“The beginning of wisdom is this: Get wisdom. Though it cost all you have, get understanding.” - Proverbs 4:7, NIV

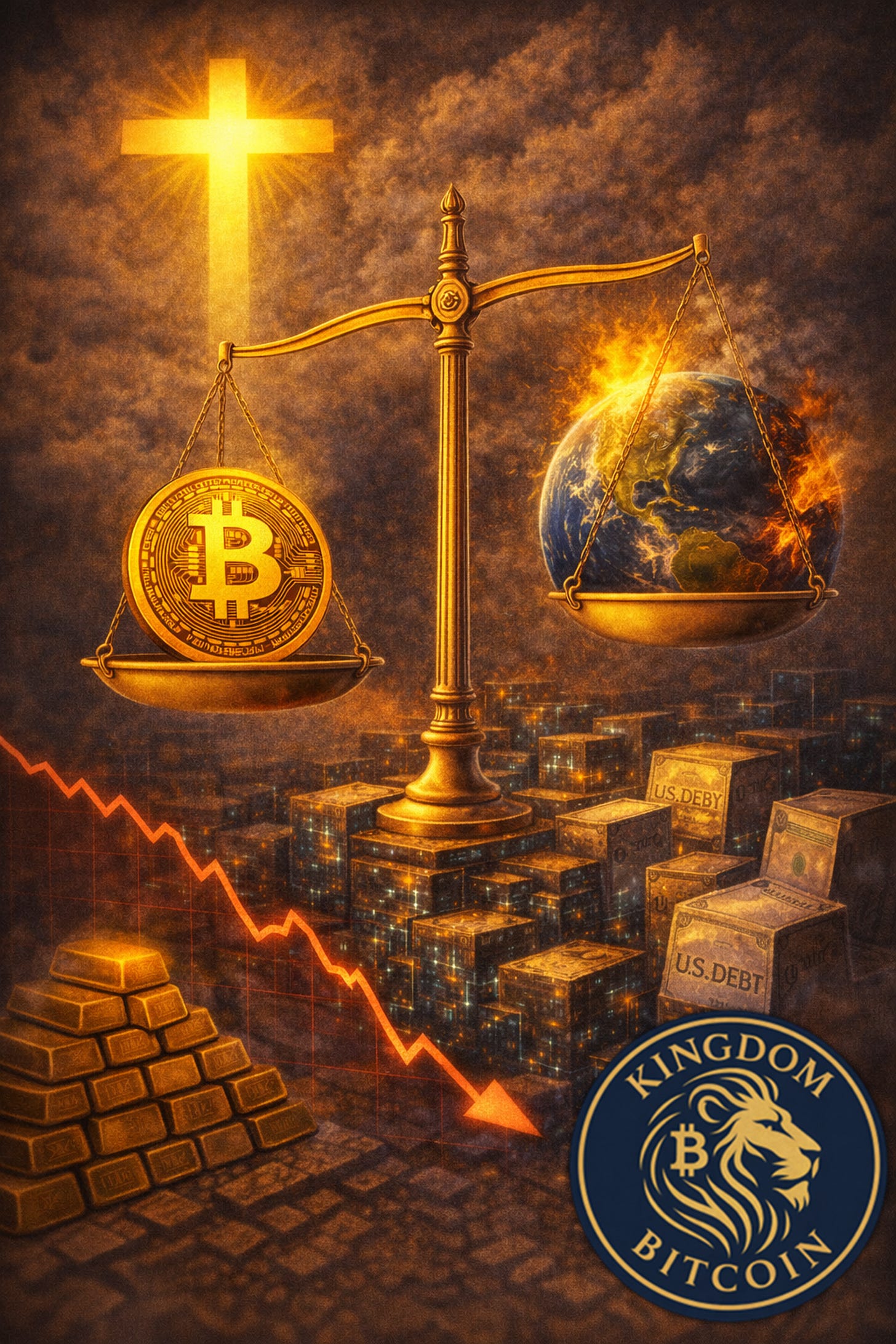

Bitcoin needs to be understood as a measuring rod. An honest scale. Not a hype object. Not a political statement. A tool that reveals how capital behaves under different conditions.

When the system is under pressure, bitcoin does not always respond the same way. That does not make it unreliable. It makes it revealing.

This post is not here to explain everything yet. It is here to help you see more clearly so the next pieces make sense. Because you are not confused because bitcoin failed. You are confused because you were handed an incomplete framework.

The so-called debasement trade is real. Debasement is the intentional reduction of a currency’s purchasing power. When governments expand money faster than productive output, purchasing power erodes. History is clear on that. Gold, Silver, and Commodities all understand that.

However, capital does not move on one variable alone. It responds to interest rates, to credibility, and to plumbing. Plumbing matters more than most people realize. It is how money actually moves through the system. Interest rates, credit availability, collateral rules, balance sheets, incentives. These are not headlines. They are the pipes behind the walls, quietly determining whether pressure builds or releases long before anyone notices a leak.

God is a God of order. Creation itself runs on systems, seasons, and boundaries. Planting and harvesting do not happen in the same moment. Neither does monetary truth.

“There is a time for everything, and a season for every activity under the heavens.” - Ecclesiastes 3:1, NIV

Bitcoin can behave very differently depending on the season. There are moments when it trades like a risk asset and moments when it behaves like hard money waiting patiently to be understood. That is not inconsistency. That is context.

Right now, we are not in a clean collapse, but we are not in a euphoric expansion either. We are in an awkward middle. Productivity is rising in some areas. Credit stress remains contained for now. Interest rates are high enough to matter but not high enough to force resolution. The system feels stable enough to delay hard questions.

That middle confuses people because it rewards patience and exposes slogans.

“The plans of the diligent lead to profit as surely as haste leads to poverty.” - Proverbs 21:5, NIV Bitcoin has always favored the diligent over the impatient.

This is where discernment matters.

Discernment is not skepticism and it is not cynicism. Discernment is the ability to hold complexity without panic. It is seeing layers instead of grabbing the first explanation that feels comforting, especially in a world training us to think in seconds instead of seasons. Markets are not always voting on the same question. At different moments they are weighing growth, liquidity, safety, or credibility. Bitcoin participates in all of those conversations, but it does not lead them all at once.

That does not make bitcoin weak.

It makes it honest.

I created this series because the noise right now is loud and shallow. Headlines want simple villains and simple heroes. God rarely works that way. He works through process, refinement, and time. Scripture does not promise instant clarity. It promises wisdom to those who seek it.

I look to do the same here. To take complex systems and, with God’s help, simplify them without distorting them. To slow the conversation down enough that understanding can actually take root.

In the next three posts, I will talk about interest rates, credibility, productivity, deflation, policy, and why bitcoin sometimes waits quietly while other assets get all the attention. I will also talk about why that waiting is not weakness. It is preparation.

For now, hold this truth. Bitcoin does not exist to make the world feel simple. It exists to tell the truth about money. And truth, especially financial truth, takes time to be recognized.

Remember, the scale is honest. The season matters. Wisdom is required.

Prayer 🙏📖🕯️

Dear Heavenly Father,

Thank You for being a God of order, patience, and truth. Teach us to seek wisdom over simplicity and discernment over noise. Help us to honor process, respect seasons, and steward what You place in our care without fear or haste.

Give us clarity where there is confusion, patience where there is delay, and humility as new systems emerge and old ones are tested. May bitcoin be a tool, not an idol, and may our understanding always remain submitted to You.

In Jesus’ name, Amen ✝️🕊️💛

This piece is absolutley brilliant. The way you connect Bitcoin's behavior to seasonal cycles rather than just viewing it as broken tech really shifted how I see market movements. I've been hodling since 2021 and always felt confused when people got anxious during quiet periods, but the "plumbing matters" concept makes so much sence now. Framing it as a measuring rod rather than hype object is gonna stick with me.