Four Part Series | Bitcoin in Context

Part 3: Good Deflation, Bad Deflation, Awkward Middle. Why Bitcoin Struggles When the System Still Looks “Fine”

A four-part Kingdom Bitcoin series

Coming up in this series:

Part 1: Setting the Table. Why “money printing” is not the whole story.

Part 2: Two Bitcoins, One Network. Why bitcoin behaves differently in different seasons.

Part 3: Good Deflation, Bad Deflation, and the Awkward Middle.

Part 4: Credibility, the Federal Reserve, and the moment truth confronts pretense.There is a particular kind of frustration that only shows up when things are not clearly broken.

When markets are collapsing, narratives are easy. When liquidity is flooding the system, stories write themselves. But when the system looks stable enough to function and strained enough to feel uneasy, people lose their bearings. That is where we are now.

This is the awkward middle.

Bitcoin struggles here, not because it is wrong, but because the world has not yet been forced to ask the question it was designed to answer.

To understand why, we need to talk about deflation. Not as a headline word, but as a lived experience inside systems.

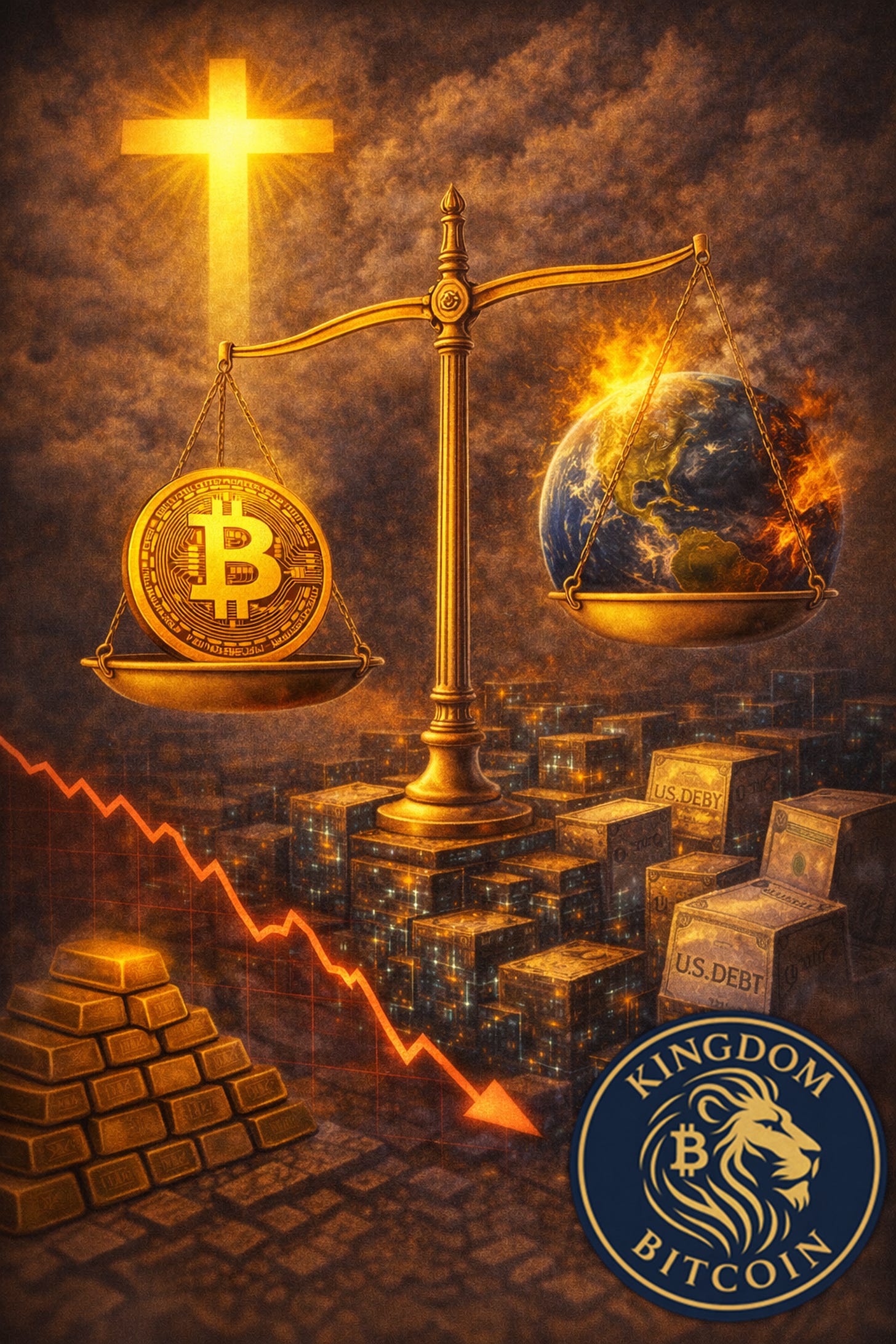

There are two kinds of deflation, and they could not be more different.

The first is good deflation. Good deflation comes from productivity. It shows up when technology improves, efficiency rises, and output increases faster than costs. Think automation, artificial intelligence, better logistics, and smarter capital allocation. Prices fall not because demand collapses, but because the same amount of effort produces more result.

This kind of deflation feels healthy. It rewards builders. It benefits consumers. It makes growth assets more attractive because future cash flows become more valuable when productivity rises. It tells a story of progress.

And here is the uncomfortable truth. Good deflation is often bad for bitcoin in the short and medium term. Not because bitcoin is broken, but because capital prefers assets that generate cash flows when the system still works. When productivity is rising and credit is contained, money flows toward growth, not toward protection. Scarcity is less compelling when abundance appears to be increasing.

This is why you can see AI stocks surge, metals rise, and bitcoin remain stuck all at the same time. Capital is not confused. It is answering a different question.

The second kind of deflation is bad deflation. Bad deflation does not come from productivity. It comes from credit contraction. Defaults. Forced selling. Broken balance sheets. When debt collapses faster than income, prices fall because demand disappears, not because efficiency improved.

This kind of deflation breaks systems. It exposes leverage. It forces central banks into impossible choices. It reveals which assets depend on trust and which ones stand without it.

Bitcoin was not designed for good deflation. It was designed for bad deflation. That is why timing matters.

Right now, we are not experiencing a credit collapse. We are not seeing widespread defaults. Banks are stressed but functioning. Governments are strained but operating. The system still looks “fine.”

Scripture has language for this condition.

“They dress the wound of my people as though it were not serious. ‘Peace, peace,’ they say, when there is no peace.”

- Jeremiah 6:14, NIV

False peace is not chaos. It is calm built on unresolved problems.

This is the awkward middle. A season where productivity rises in pockets, markets function, and structural imbalances quietly compound. Nothing forces immediate reckoning. Everything encourages delay.

That delay is why bitcoin waits. While bitcoin waits, other assets absorb capital.

There are three massive competitors pulling attention away from bitcoin in this season.

The first is AI and growth investment. Artificial intelligence represents the largest productivity surge in decades. It promises real output, real revenue, and real transformation. When rates are high but manageable, capital flows toward growth stories with visible returns. This is good deflation at work, and it soaks up enormous amounts of money.

The second is housing. Real estate remains the primary store of wealth for households and institutions alike. Even when affordability strains, housing benefits from leverage, tax advantages, and social reinforcement. As long as credit is available and prices do not collapse, housing continues to dominate capital allocation.

The third is Treasuries. Despite debt concerns, sovereign bonds remain the benchmark. They offer yield, liquidity, and institutional acceptance. As long as Treasuries are treated as credible, they pull capital that bitcoin cannot yet access.

Together, these three markets represent nearly $100 Trillion dollars. They do not need to collapse for bitcoin to succeed. They simply need to lose credibility. That has not happened yet.

Scripture warns us about this kind of misplaced confidence.

“Watch out! Be on your guard against all kinds of greed; life does not consist in an abundance of possessions.”

- Luke 12:15, NIV

Abundance can deceive. Stability can anesthetize. Prosperity without justice eventually fractures.

Haggai spoke to a people living comfortably while foundations crumbled.

“You have planted much, but harvested little… You earn wages, only to put them in a purse with holes in it.”

- Haggai 1:6, NIV

Delay is the season we are in. Bitcoin exposes this delay by refusing to perform on command. It does not surge simply because money exists. It waits until trust erodes. Until benchmarks strain. Until the question changes from “Where can I grow?” to “What can I rely on?”

This is why the current moment feels frustrating. Good deflation tells a hopeful story. Bad deflation tells a painful truth. We are living between the two.

Bitcoin is not broken in this season. It is still early. Think of the upcoming Super Bowl as an analogy. We are only at the national anthem before the game even begins.

And early feels lonely when the crowd is still comfortable.

In the final post of this series, we will talk about credibility. Interest rates. Policy. And why certain choices by central banks matter far more than inflation prints. We will also talk about how moments of forced honesty arrive, often suddenly, after long periods of delay.

For now, remember this.

Systems can look stable and still be fragile.

Peace can be declared while pressure builds.

And truth often waits quietly until it is needed.

Bitcoin is patient because it was built for honesty, not applause.

Prayer 🙏🌍🕊️

Heavenly Father, Thank You for being a God of truth, not illusion.

Give us discernment in seasons of false peace. Help us see beneath appearances and steward wisely when comfort tempts complacency. Teach us to trust You more than systems, and to value truth even when it waits.

May bitcoin remain a tool, not an idol.

May prosperity never replace justice.

And may Your Spirit guide us through seasons of delay with faith and patience.

In Jesus’ name, Amen. ✝️🔥💛