Four Part Series | Bitcoin in Context

Part 2: Two Bitcoins, One Network. Why Bitcoin Behaves Differently in Different Seasons

A four-part Kingdom Bitcoin series

Coming up in this series:

Part 1: Setting the Table. Why “money printing” is not the whole story.

Part 2: Two Bitcoins, One Network. Why bitcoin behaves differently in different seasons.

Part 3: Good Deflation, Bad Deflation, and the Awkward Middle.

Part 4: Credibility, the Federal Reserve, and the moment truth confronts pretense.Bitcoin confuses people because they expect it to behave the same way in every environment. When it doesn’t, they assume something is wrong. Either the thesis failed, the narrative broke, or the promise was overstated.

The problem is not bitcoin.

The problem is expectation without context.

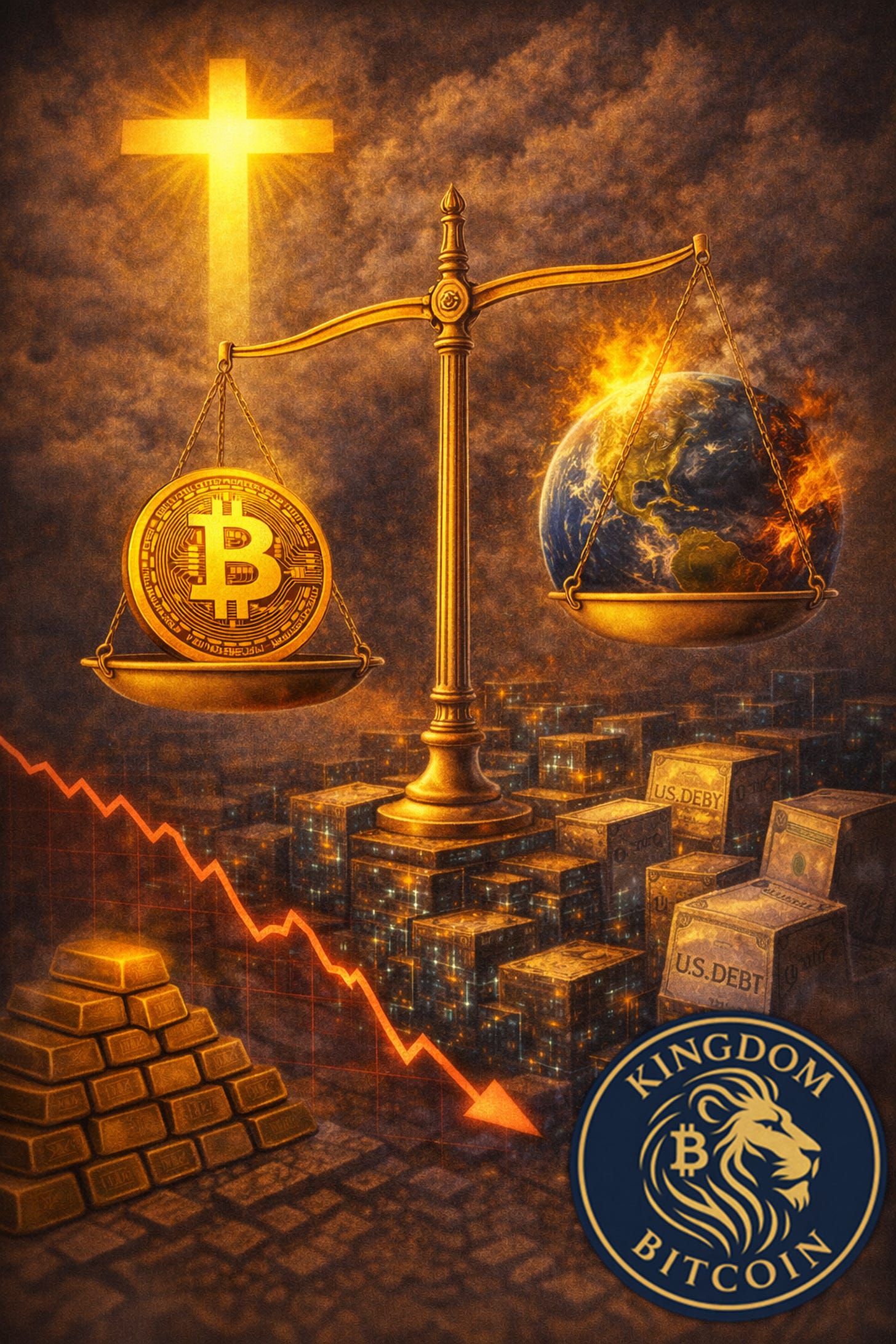

Bitcoin is one network, one codebase, one monetary system. But it has more than one expression. Not because it is inconsistent, but because the world does not ask the same question in every season.

This is what I mean when I say there are two bitcoins. Not two assets. Not two ideologies. Two expressions of the same network responding honestly to different regimes.

To explain this simply, we need one definition.

In finance, rho measures how sensitive an asset is to interest rates. When rates change, some assets benefit and others suffer. Applied to bitcoin, rho helps explain why it sometimes trades like a risk asset and other times like hard money.

There is negative-rho bitcoin. This is the bitcoin people recognize from 2020 and 2021. Rates fall. Liquidity expands. The system remains intact. Cash becomes less attractive to hold. Capital looks for opportunity. In that environment, bitcoin behaves like a high-beta asset, meaning it amplifies market moves rather than dampening them. It moves fast. It rewards risk-taking hence the term “Risk On.” The opportunity cost of holding bitcoin drops as yields fall elsewhere.

This is not bitcoin failing or compromising. It is bitcoin responding honestly to continuity.

There is also positive-rho bitcoin. This version emerges when the question shifts. Not “Where can I grow?” but “What can I trust?” In this regime, the risk-free rate itself begins to feel fragile. Duration assets (i.e. bonds) wobble. Benchmarks strain. Credibility becomes scarce. Bitcoin’s lack of yield stops being a weakness and becomes a strength. It does not depend on promises, policies, or projections. It simply exists, scarce and neutral.

That expression does not require falling rates. It appears when confidence in the system begins to fracture.

These two expressions are not in conflict. They are context-dependent. What confuses people today is that we are not clearly in either regime. We are in an awkward middle.

Productivity is rising in certain sectors. Credit stress is present but contained. Treasuries are still treated as credible. Interest rates are high enough to matter but not high enough to force resolution. This creates a Goldilocks environment where bitcoin must compete with massive capital sinks like growth investment, housing, and sovereign debt (more on this in Part 3).

In that environment, bitcoin waits. Not because it is broken. Because the question being asked is not yet the one it was built to answer.

This is why a single thesis will always fail. You do not need a slogan. You need a regime map. Bitcoin can be a high-beta liquidity asset in continuity and a non-sovereign hard asset in rupture. Those are different seasons with different triggers. Expecting one behavior everywhere guarantees confusion.

Scripture actually prepares us for this kind of maturity clearly. Jesus starts with soil, not speed.

“But the seed falling on good soil refers to someone who hears the word and understands it. This is the one who produces a crop.”

- Matthew 13:23, NIV

Same seed. Same truth. Different environments. The outcome is not determined by the seed’s potential, but by the condition of what receives it. Growth is not instant. It is seasonal. It requires depth, patience, and time underground where nothing looks like it is happening. Waiting feels unproductive until you realize it’s the season where roots form.

Bitcoin works the same way.

The network does not change. What changes is the soil. The macro environment. The questions capital is asking. The season the system is in. When the soil is shallow, growth looks fast but fades quickly. When the soil is deep, growth is slower, quieter, and far more durable.

Hebrews then sharpens the point.

“By this time you ought to be teachers, but you need someone to teach you the elementary truths of God’s word all over again. You need milk, not solid food.”

- Hebrews 5:12, NIV

Milk is immediate. It is easy to digest and satisfies short-term hunger. Solid food takes time. It requires patience. It assumes maturity. It nourishes for endurance, not speed.

Bitcoin is certainly not milk. It was never designed for instant gratification or shallow understanding. It rewards those willing to move past slogans and into discernment. Those who can sit with complexity. Those who can wait through seasons where nothing looks obvious.

This is not a failure of the seed. It is a test of the soil. And it is a test of maturity. That does not make bitcoin weak. It makes it honest.

Right now, we are in a season that tests patience more than conviction. Continuity has not broken. Credibility has not collapsed. Liquidity still competes for attention. This is the season where slogans fail and discernment matters.

The Kingdom of God works the same way. Already present, not yet complete. Faith is proven in waiting. Truth is revealed over time, not on demand.

If you judge a seed by how fast it sprouts, you misunderstand growth. If you demand harvest during planting season, you damage the field. Bitcoin is teaching patience to those willing to learn.

In the next post, we will move deeper into the system itself. Interest rates. Credibility. Policy. Why certain choices by central banks matter far more than headlines. And why bitcoin’s most powerful moments often arrive after people stop paying attention.

For now, hold onto this principle.

There are not two bitcoins.

There is one network.

Seen through different seasons.

Measured by an honest scale.

Prayer 🙏🌍🕊️

Heavenly Father, Thank You for being a God of order, seasons, and truth.

Give us discernment where others demand shortcuts. Teach us to recognize timing, to honor process, and to trust You when clarity unfolds slowly. Help us steward resources with wisdom, not impatience, and faith, not fear.

May bitcoin remain a tool, never an idol.

May wealth serve Your purposes, not replace them.

And may Your Spirit guide us as we learn to see clearly and wait faithfully.

In Jesus’ name, Amen. ✝️💛🔥