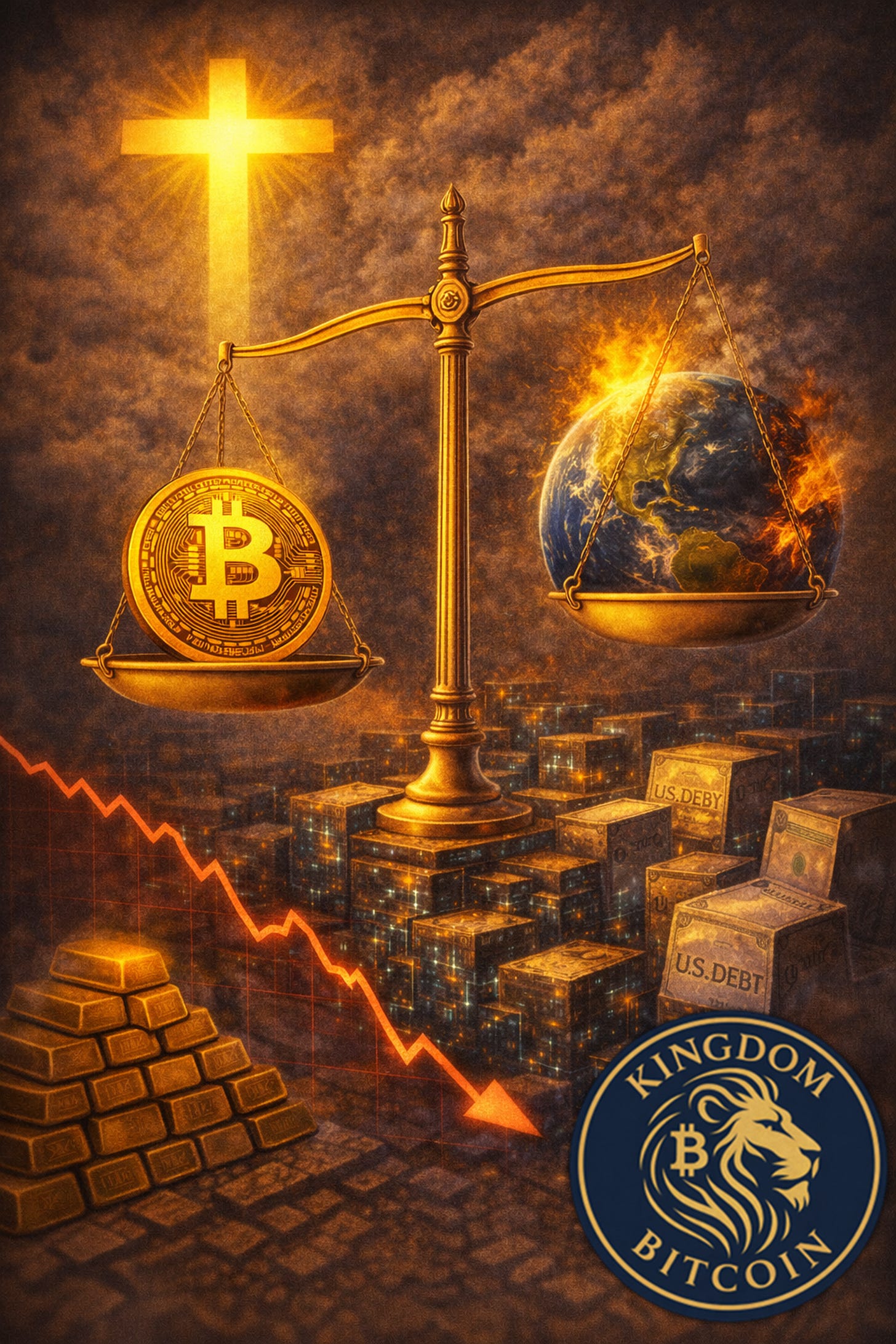

Four Part Series | Bitcoin in Context

Part 4: Fed-elect Kevin Warsh and the Moment of Truth. When Orthodoxy Collides with Reality

A four-part Kingdom Bitcoin series

Coming up in this series:

Part 1: Setting the Table. Why “money printing” is not the whole story.

Part 2: Two Bitcoins, One Network. Why bitcoin behaves differently in different seasons.

Part 3: Good Deflation, Bad Deflation, and the Awkward Middle.

Part 4: Credibility, the Federal Reserve, and the moment truth confronts pretense.If you are thinking about bitcoin as a trade, this post will feel uncomfortable. If you are thinking about bitcoin as generational capital, this post should finally bring relief. Because the most important question was never, “Where is the bottom?”

The right question is this: What is the probability that bitcoin meaningfully outperforms all major asset classes over the next 10 to 30 years, and what acquisition strategy best captures that reality without relying on timing genius?

Once you ask it that way, the fog begins to lift.

Recently President Trump nominated Kevin Warsh to become the next Federal Reserve Chairman. This matters because Mr. Warsh forces that question into the open.

Not because of who he is, but because of what he represents. A credibility-first posture. An orthodox view of monetary policy that believes prices, including interest rates, should reflect reality rather than conceal it. A resistance to endless accommodation. A willingness to let capital feel pressure instead of numbing it.

That posture is uncomfortable in the short term. Especially for bitcoin.

Higher structural rates raise the opportunity cost of holding non-yielding assets. Liquidity tightens. Risk assets struggle. Bitcoin can and often does fall in these environments. Exactly as we have seen. Mechanically, it still lives inside portfolios that respond to real rates, funding conditions, and balance sheet constraints.

This is why a Warsh-like Fed often looks bearish for bitcoin at first glance. But that is not the full story as this series has clearly pointed out.

A credibility-first Fed reduces “extend and pretend.” It forces bad balance sheets to be recognized earlier. It changes bank incentives when free carry assumptions break. It exposes the hidden costs of mechanisms like interest on reserve balances. It replaces comfort with honesty.

And honesty has consequences.

Debt math does not disappear because we want it to. As rates stay higher for longer, debt service costs rise. Treasury issuance expands. Auction demand matters more. Term premium stops behaving politely. The yield curve begins to signal stress rather than reassurance.

This is where bitcoin’s true moment lives.

Not in CPI (Inflation) prints.

Not in headlines.

But in the plumbing.

Watch funding stress. Watch auction weakness. Watch collateral rules. Watch bank balance sheet constraints. Watch term premium spikes. When the yield curve itself becomes suspect, when the benchmark used to price all assets starts to wobble, something profound changes.

This is positive-rho bitcoin. Positive-rho bitcoin does not need easing. It needs disbelief. It does not require falling rates. It emerges when confidence in the so-called risk-free rate fractures. When duration assets (i.e. bonds) begin to implode under their own assumptions. When promises become heavier than math.

Bitcoin does not depend on those promises. It has no cash flows to discount. No issuer to pressure. No policy path to believe in. It simply exists, scarce and neutral, bearing witness to what remains when credibility fails.

This is why bitcoin is not ultimately a hedge or a trade. It is a witness.

Scripture has language for moments like this.

“There is nothing concealed that will not be disclosed, or hidden that will not be made known.”

- Luke 12:2, NIV

Delay is not resolution. It is accumulation. And we have lived through a long season of delay. This started in 1971.

Financial repression. Managed decline. Quiet rule changes. Stealth taxation. Policies designed to preserve appearances rather than restore foundations. This is not collapse. It is something more subtle and more dangerous. A system that still looks fine while becoming fragile underneath.

The prophets warned about this kind of false peace.

“They dress the wound of my people as though it were not serious. ‘Peace, peace,’ they say, when there is no peace.”

- Jeremiah 6:14, NIV

This is where many investors get lost. They expect one story to work in every regime. They want a single thesis. But bitcoin requires a regime map.

In continuity, bitcoin behaves like a high-beta liquidity asset. In easing cycles, it can surge, compete with growth, and reward risk appetite.

In rupture, bitcoin becomes something else entirely. A non-sovereign hard asset that benefits not from liquidity, but from credibility failure.

Those are not contradictions. They are seasons. This brings us to the long view.

If you step back and look at the next several decades, you can outline four broad macro paths. Extended continuity. Financial repression leading to reset. Benchmark failure. Or hard suppression.

When you weight them honestly, something remarkable emerges.

There is an overwhelming probability that bitcoin outperforms cash and sovereign bonds over long horizons. A strong probability that it becomes a primary intergenerational wealth rail. And a non-trivial probability that it becomes foundational capital when benchmark credibility finally breaks.

That is an extraordinary asymmetric profile. Which leads to a sobering sentence that deserves to be read slowly.

If bitcoin fails over a 30-year horizon, it likely means every fiat-anchored promise succeeded beyond historical precedent.

That is not rhetoric. It is a conditional claim grounded in history.

Fiat systems rely on promises. Governments promise to honor debt. Central banks promise to preserve purchasing power. Pension systems promise future payouts. Banks promise solvency. Politics promises restraint.

Bitcoin does not need all of those to fail. It only needs one to fail systemically.

For bitcoin to fail over decades, all of them must hold continuously across wars, elections, recessions, technological shocks, and demographic shifts.

That has never happened before. Think of 2020 with a pandemic shut down, 2008 great financial crisis. Since 1971, there have been seven recessions, four major wars, eleven significant military operations.

There is no example of a long-lived fiat system aging gracefully under rising debt without default, repression, or debasement. Incentives do not allow it. Policymakers are rewarded for short-term stability, not long-term discipline.

Bitcoin does not bet on malice.

It bets on incentives.

This is why generational acquisition is not about brilliance. It is about discipline. Exposure bands instead of price targets. Time instead of leverage. Preparation for liquidity crises rather than fear of them. Self-custody not as a technical detail, but as part of the return.

Hebrews describes what happens when delay finally gives way to truth.

“The words ‘once more’ indicate the removing of what can be shaken, so that what cannot be shaken may remain.”

- Hebrews 12:27, NIV

Shaking is not destruction.

It is separation.

Bitcoin was built for that separation.

Not to overthrow systems.

Not to evangelize markets.

But to remain.

That is why I wrote this series. Not to predict timelines, but to teach discernment. Not to chase narratives, but to understand seasons.

Bitcoin is not a bet that the world ends.

It is a bet that humans remain human. That debt remains tempting. That power remains political. And that truth, eventually, attracts capital.

Prayer 🙏🔥🌍

Heavenly Father, Thank You for being a God of truth that cannot be shaken.

Give us wisdom beyond headlines and patience beyond fear. Help us steward well in seasons of delay and stand firm in seasons of reckoning. Teach us to value what endures over what dazzles.

May bitcoin be a tool, never an idol.

May truth rise where pretense once ruled.

And may we be found faithful when systems are tested.

In Jesus’ name, Amen. ✝️🕊️💛