Epilogue | Bitcoin in Context

Epilogue: The Honest Scale and the Long View

A four-part Kingdom Bitcoin series

Coming up in this series:

Part 1: Setting the Table. Why “money printing” is not the whole story.

Part 2: Two Bitcoins, One Network. Why bitcoin behaves differently in different seasons.

Part 3: Good Deflation, Bad Deflation, and the Awkward Middle.

Part 4: Credibility, the Federal Reserve, and the moment truth confronts pretense.

EpilogueIf you read this series hoping for a prediction, you may feel unsatisfied. If you read it hoping for understanding, you are right on time. Bitcoin does not reward those who need certainty on demand. It rewards those willing to grow into discernment.

Across these four posts, price targets were intentionally ignored. Headlines were left untouched. Money was treated as it actually is: layered, conditional, and deeply human. The goal was quieter and far more useful than prediction. It was learning how to see.

I taught that bitcoin is not broken. Expectations are.

I shared that bitcoin is not one thing in every season, but one network expressed honestly under different conditions. Sometimes it behaves like a high-beta liquidity asset when continuity holds and rates fall. Other times it behaves like hard money when credibility fractures and the benchmark itself is questioned. That duality is not confusion. It is truthfulness.

Not all deflation is the same, and pretending otherwise has confused an entire generation of investors. Productivity-driven deflation can feel prosperous while quietly sidelining bitcoin. Credit deflation feels violent and often reveals why bitcoin exists at all. And I named the frustration of living in the awkward middle, where things look fine, but feel fragile.

Bitcoin’s true competitors are not narratives, but capital sinks. AI growth. Housing. Treasuries. Each absorbs capital when the system still appears credible. And when those sinks dominate, bitcoin waits.

Not weakly. Patiently.

Then I confronted the deeper question. Not where the bottom is, but what the long game looks like. What probability-weighted outcomes actually matter over decades. What it would take for bitcoin to truly fail. And what it would take for every fiat promise to succeed beyond historical precedent.

That is where the series ends. And where wisdom begins.

Scripture calls this kind of seeing maturity.

“The beginning of wisdom is this: Get wisdom. Though it cost all you have, get understanding.”

- Proverbs 4:7, NIV

Wisdom does not flatten reality into slogans. It understands seasons. It knows that planting and harvest are separated by long stretches underground where nothing appears to be happening.

Jesus taught this plainly through soil.

“But the seed falling on good soil refers to someone who hears the word and understands it. This is the one who produces a crop.”

- Matthew 13:23, NIV

Same seed. Same truth. Different soil. Different outcome.

Bitcoin is the seed. The network does not change. What changes is the soil. The macro environment. The credibility of systems. The questions capital is asking.

And this is where the Kingdom lens matters most.

False peace always looks convincing right before it fails. Systems often appear stable right before they are shaken. Prosperity without justice can last longer than expected, but not forever.

“They dress the wound of my people as though it were not serious. ‘Peace, peace,’ they say, when there is no peace.”

- Jeremiah 6:14, NIV

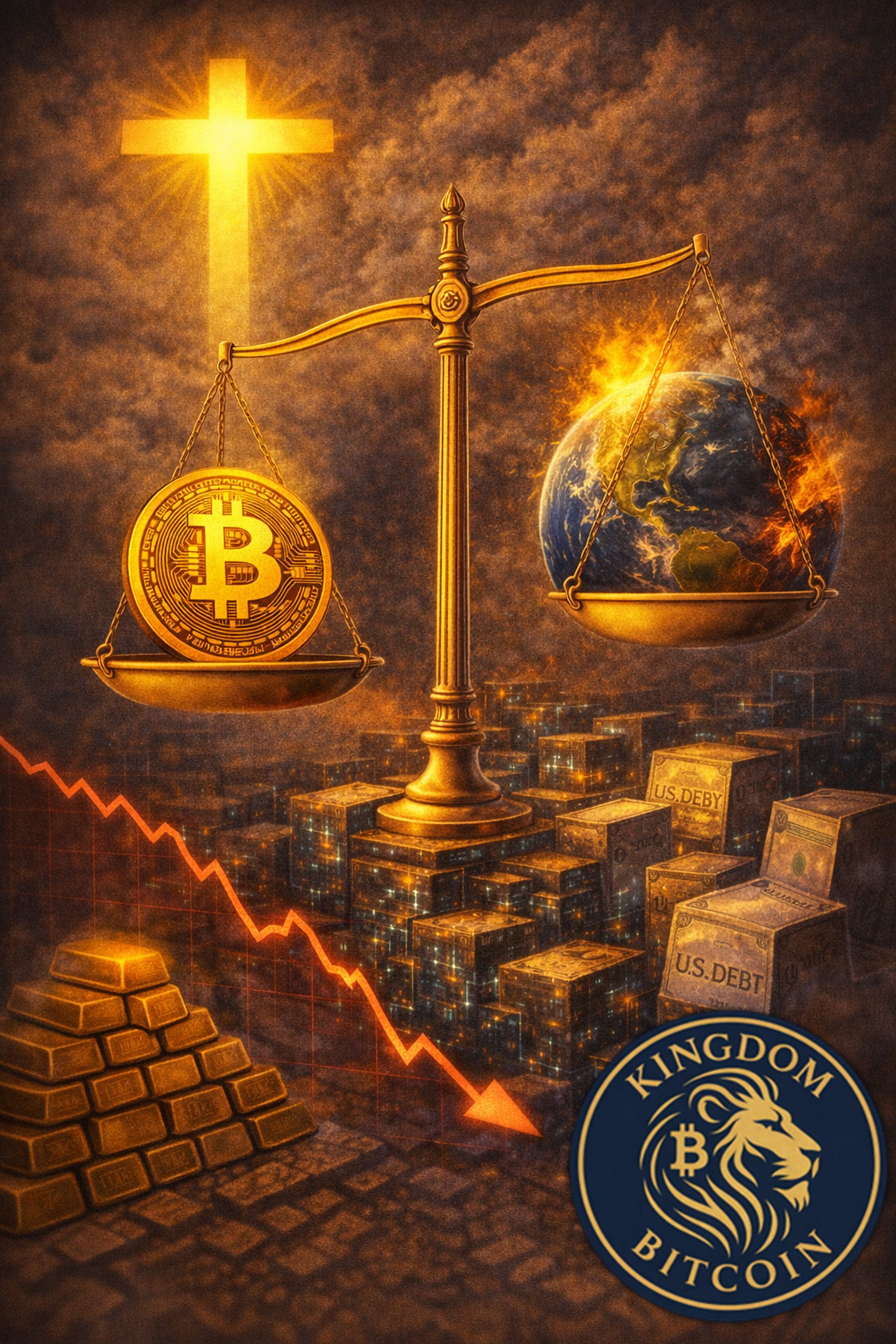

Bitcoin is not here to promise peace. It is here to measure truth.

That is why it often feels early. Why it frustrates those who want instant validation. Why it rewards patience more than brilliance. Why it exposes incentives instead of judging motives.

Bitcoin does not bet on the end of the world. It bets on humans remaining human. On power remaining political. On debt remaining tempting. On truth eventually attracting capital.

That is not cynicism. It is sobriety, which is a gift.

One of the quietest lessons in this series is this: volatility is not the enemy of generational wealth. Short-term thinking is. Missing exposure is often more dangerous than imperfect timing. Liquidity crises are not curses if you are prepared. They are invitations.

The Kingdom works the same way.

Faith is not proven in excitement. It is proven in waiting. In stewardship without applause. In obedience before clarity. In trusting that what cannot be shaken will remain.

“The words ‘once more’ indicate the removing of what can be shaken, so that what cannot be shaken may remain.”

Hebrews 12:27, NIV

This is why bitcoin is not ultimately a trade, hedge, or even a prophecy. It is a witness. A witness to monetary truth and incentive structures. When financial credibility thins, bitcoin endures. Like all true witnesses, it does not shout. It stands.

If this series has done its work, you are not more anxious about price. You are calmer about time. You are less reactive to noise. More attentive to plumbing. More patient with seasons. More grounded in discernment.

That is the goal. Not speculation, but stewardship. Not urgency, but understanding. Not fear, but wisdom.

The scale is honest.

The seasons are real.

Wisdom is required.

Prayer 🙏🕊️🔥

Dear God, Thank You for being a God of truth, order, and time.

Teach us to see clearly in noisy seasons. To steward patiently when outcomes are delayed. To value what endures over what dazzles. And to trust You when systems shake and clarity feels distant.

May we hold tools without worshiping them.

May we seek wisdom before certainty.

And may we be found faithful stewards for generations to come.

In Jesus’ name, Amen. ✝️💛