Dominance Is Maturity, Not Maximalism

Why Bitcoin’s Market Share Is the Clearest Signal of Where We Are

Yesterday we named the separation.

Today we explain what it means.

Bitcoin dominance is one of the most misunderstood signals in this entire market. Too often it is treated as a tribal metric. Bitcoin versus crypto. Maximalism versus experimentation. That framing misses the point entirely.

Dominance is not ideology.

It is behavior.

Bitcoin dominance measures the percentage of total digital asset market value that belongs to bitcoin alone. When dominance rises, capital is consolidating into the most trusted, durable asset. When dominance falls, capital is dispersing outward into higher-risk crypto alternatives aka altcoins.

That makes dominance a maturity signal, not a popularity contest.

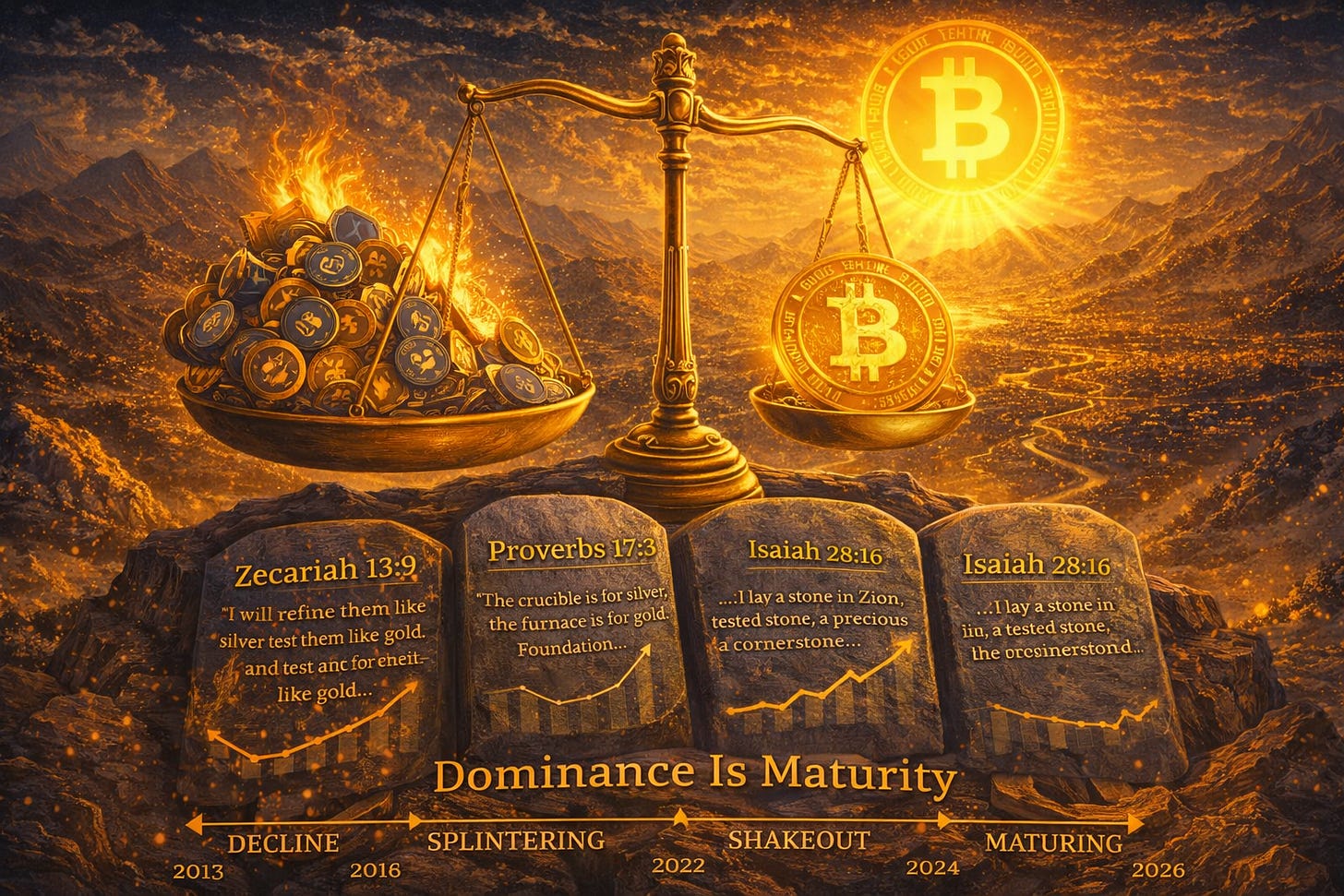

When you step back and look at the full historical arc, a clear pattern emerges.

From 2013 to 2016, bitcoin dominance steadily declined as new crypto experiments entered the ecosystem. This was healthy. Exploration follows discovery. Innovation spreads capital outward.

In 2017, dominance collapsed during peak speculation. Initial Coin Offerings (ICOs), crypto’s version Initial Public Offerings (IPOs), mania flooded the market. Capital chased promises, whitepapers, and velocity. Everything went up together, until it didn’t.

From 2018 through 2021, capital fragmented across thousands of tokens. Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), yield schemes, governance experiments. This was not failure. It was adolescence. Markets testing boundaries, incentives, and assumptions.

Then came 2022 and 2023. The shakeout began. Excess leverage unwound. Fragile designs failed. Trust broke, not because of volatility, but because of structural weakness. Capital stopped asking, “What’s next?” and started asking, “What’s real?”

That brings us to 2024 through 2026 and this is the tell.

Bitcoin dominance rose during a bull cycle. Historically, that should not happen.

In past cycles:

Bull markets meant bitcoin dominance fell as speculation expanded

Bear markets meant bitcoin dominance rose as risk contracted

This cycle broke that pattern.

Instead of capital rushing outward as prices recovered, it consolidated inward. From roughly 36.6% to over 57%, trust didn’t scatter, it concentrated. That is not exuberance. That is discernment.

God does not expose truth by accident. He reveals it through pressure.

“I will refine them like silver and test them like gold. They will call on my name and I will answer them.” - Zechariah 13:9

Refining is not destructive. It is concentrating. Fire does not eliminate what is real. It removes what is not.

“The crucible is for silver, and the furnace is for gold, and the Lord tests hearts.” - Proverbs 17:3

Value is not declared. It is proven. Testing does not create worth. It reveals it.

“See, I lay a stone in Zion, a tested stone, a precious cornerstone… the one who relies on it will never be stricken with panic.” - Isaiah 28:16

What endures pressure does not induce fear. It anchors it. This is exactly what bitcoin dominance is showing us.

As pressure increased, capital did not scatter. It concentrated. Not because alternatives disappeared, but because conviction matured. In seasons of refining, weight moves toward what has already been tested. Not what promises more, but what has proven it needs to change less.

Fire reveals structure. Testing reveals truth. Foundations reveal where panic ends.

This cycle is not separating assets by performance.

It is separating systems by endurance.

Bitcoin dominance rising is a signal that the market is growing up. Maturing right before our very eyes.

Infrastructure is being distinguished from experimentation. Standards are separating from categories. Capital is no longer optimizing for speed, but for permanence. For settlement assurance. For systems that do not change rules when stressed.

This does not mean innovation ends. It means innovation finally has a foundation. Exploration continues, but responsibility increases. Builders begin to optimize for durability instead of attention.

Bitcoin is no longer competing for excitement.

It is being selected for weight.

The next phase will not be louder.

It will be heavier.

And systems that can bear weight are the ones that endure.

This cycle is not about everything winning.

It is about the right things remaining.

And that distinction changes everything.

Prayer 🙏✝️🕊️

Father God, Thank You for being a God who refines, not confuses.

Thank You for allowing shaking so that truth can be revealed and foundations can remain.

Give us discernment in noisy seasons. Teach us to recognize what endures, not just what excites. Help us steward wisely, choose substance over spectacle, and build on what You have designed to last.

May our faith, our work, and our decisions be rooted in what cannot be shaken.

In Jesus’ name, Amen. 🔥🙏✨