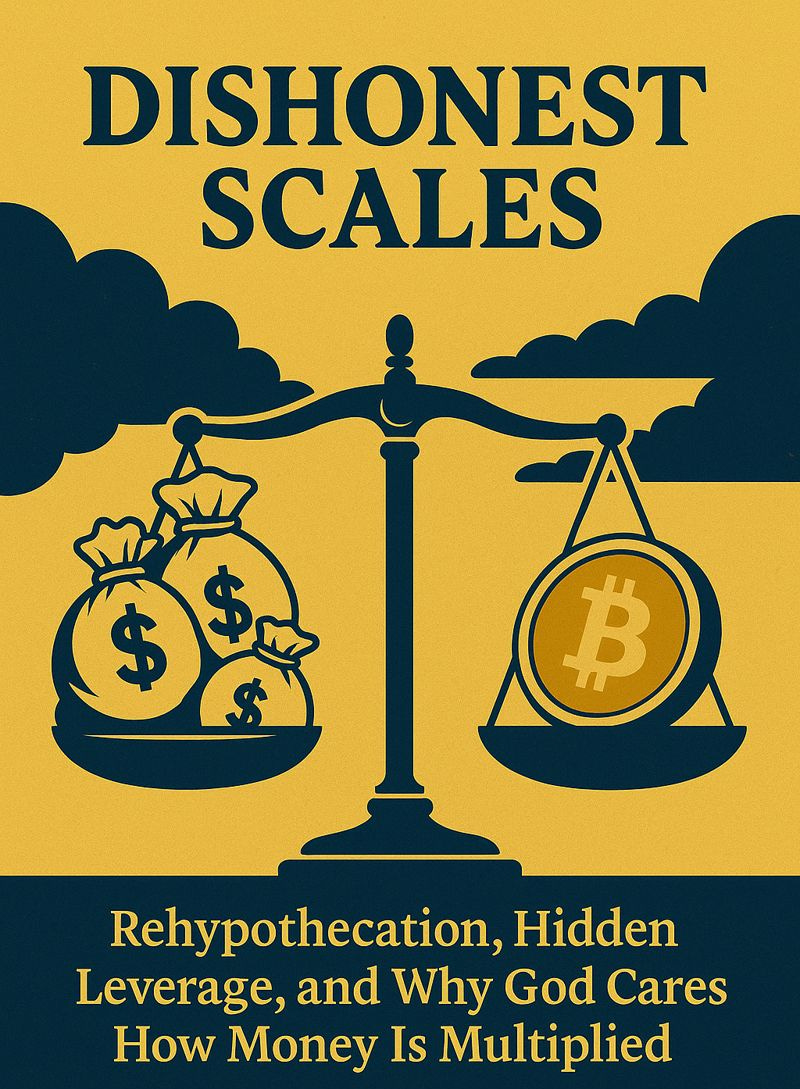

Dishonest Scales: Rehypothecation

Rehypothecation, Hidden Leverage, and Why God Cares How Money Is Multiplied

There is a word buried deep in finance that almost no everyday person ever hears, yet it explains why systems collapse and why trust keeps breaking.

Rehypothecation.

At its simplest, rehypothecation means this. An institution takes an asset you deposited for safekeeping and uses it again for its own purposes. Then it often uses it again. And again. The same underlying asset supports multiple claims at the same time.

It is legal.

It is common.

It is deeply fragile.

Banks do this with deposits. Brokers do it with securities. Commodity markets do it with gold. Crypto exchanges do it with digital assets. One ounce, one share, one bitcoin becomes many promises on paper.

This is why rehypothecation exists. It creates leverage. It increases liquidity. It makes balance sheets look stronger than they really are. It allows institutions to earn yield on assets they do not truly own.

But leverage always has a cost.

Rehypothecation works only as long as not everyone asks for their asset at the same time. The moment confidence cracks, the system reveals itself. There are more claims than there are assets. Someone will not be made whole.

This is not a technical problem. It is a moral one.

Scripture speaks directly to this pattern.

“The Lord detests dishonest scales, but accurate weights find favor with him.”

- Proverbs 11:1

Rehypothecation is a dishonest scale. It pretends abundance where there is scarcity. It multiplies claims without multiplying substance. It rewards speed over stewardship and confidence over truth.

This is why bitcoin is disruptive.

Bitcoin does not allow rehypothecation at the protocol level. One bitcoin cannot exist in two places at the same time. It cannot be duplicated. It cannot be promised to multiple owners unless humans reintroduce trust layers on top of it.

When bitcoin is held in self custody, it is final. There is no balance sheet above you. No counterparty beneath you. No leverage quietly built against your ownership.

But when bitcoin is held inside centralized platforms, the old system returns. The same incentives appear. Yield products. Lending desks. Synthetic exposure. The temptation to reuse customer assets becomes overwhelming.

This is not about accusing motives. It is about understanding structures.

Jesus warned us that where treasure is stored determines where trust flows.

“For where your treasure is, there your heart will be also.” - Matthew 6:21

When assets are pooled, rehypothecated, and abstracted, responsibility dissolves. When ownership is direct, stewardship becomes personal.

The Kingdom principle is simple. God does not bless multiplication built on deception. He blesses fruit that comes from faithfulness.

“Whoever can be trusted with very little can also be trusted with much.” - Luke 16:10

Bitcoin offers something rare. An asset that forces honesty. It removes the illusion of infinite leverage. It exposes the cost of convenience. It invites people back into responsibility.

Rehypothecation teaches dependence on systems.

Bitcoin teaches accountability before God.

One expands by hiding risk.

The other grows by revealing it.

Traditional Finance Examples Where Rehypothecation Failed

Lehman Brothers (2008)

Lehman rehypothecated client collateral extensively, and when it collapsed, customers discovered their assets had been reused multiple times and were trapped in bankruptcy for years.

MF Global (2011)

MF Global illegally rehypothecated customer funds to cover proprietary trades, resulting in missing customer assets after the firm filed for bankruptcy.

Great Depression Bank Runs (1930–1933)

Banks rehypothecated deposits through fractional reserves, and when confidence broke, millions of Americans learned their money had been lent out and was unavailable.

London Gold Market (Ongoing)

The gold market operates on extreme rehypothecation, with hundreds of paper claims per physical ounce, meaning most “gold owners” cannot take delivery simultaneously.

Repo Market Freeze (2019)

Overleveraged rehypothecation in overnight lending markets caused a sudden liquidity freeze, forcing the Federal Reserve to intervene to prevent systemic failure.

Crypto Examples Where Rehypothecation Failed

FTX (2022)

FTX rehypothecated customer bitcoin and crypto deposits through Alameda Research, and when customers asked for withdrawals, the assets were gone, triggering one of the largest fraud-driven collapses in financial history.

Celsius Network (2022)

Celsius rehypothecated customer bitcoin into opaque lending and yield strategies, leaving depositors unsecured creditors when liquidity evaporated and withdrawals were frozen.

BlockFi (2022)

BlockFi reused customer assets for lending and collateral purposes, and when counterparties failed during the market downturn, customers discovered their “held” assets were encumbered.

Voyager Digital (2022)

Voyager rehypothecated user funds into high risk loans to firms like Three Arrows Capital, and when those loans defaulted, customer balances became unrecoverable claims.

The Pattern That Never Changes

In every case, the story is the same:

The asset existed.

The claims multiplied.

Confidence broke.

Reality won.

Rehypothecation always looks safe until it matters most.

Prayer

Father, give us wisdom to see what is hidden and courage to choose truth over convenience. Teach us to steward what You entrust to us with integrity, patience, and humility. Guard us from systems that promise multiplication without faithfulness. Lead us by Your Spirit into clarity, responsibility, and trust that rests first in You. Amen.