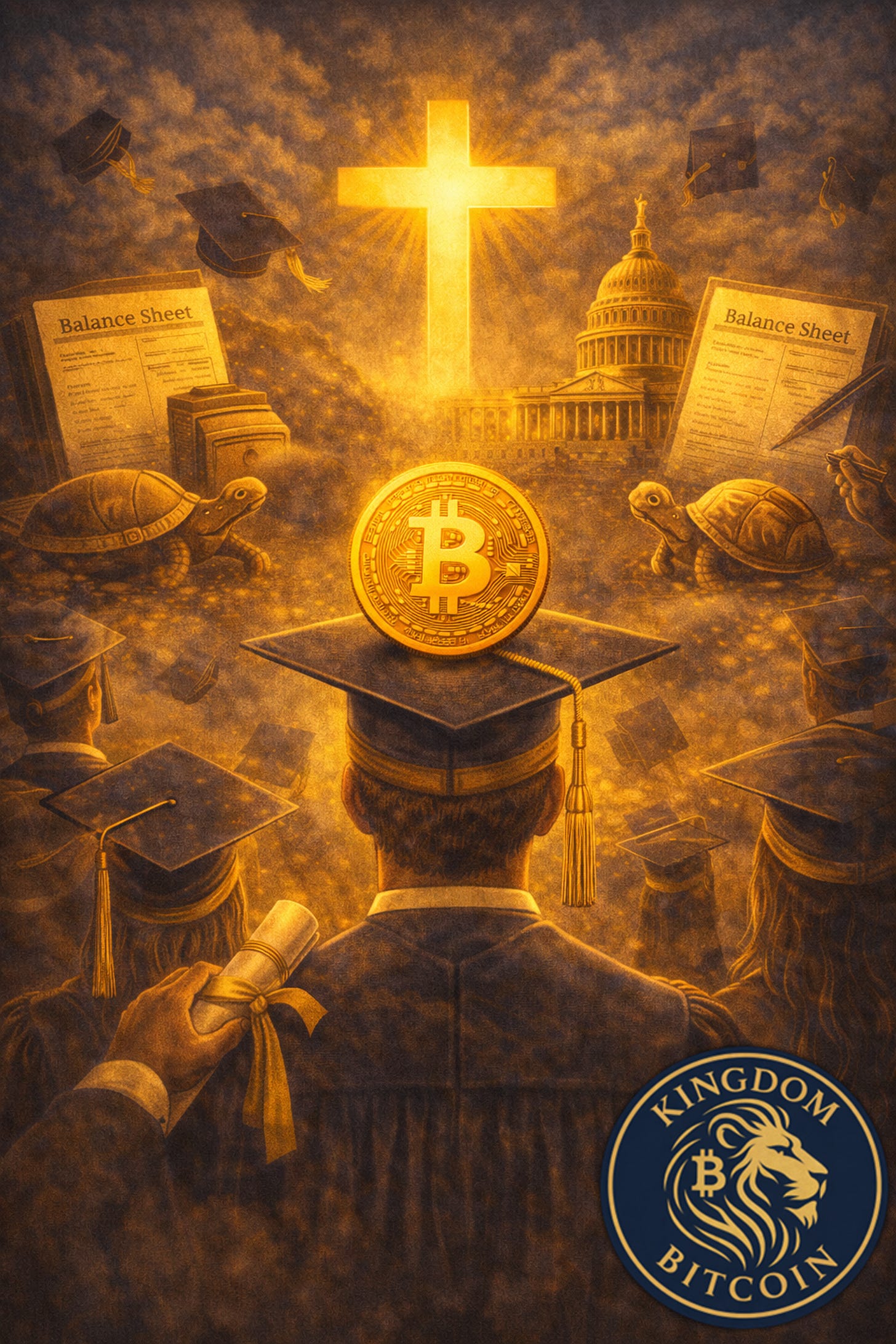

Bitcoin Has Graduated

From digital cash to global neutral collateral

One of the most misunderstood shifts of this decade is the quiet death of the “bitcoin as spending money” narrative.

We are not buying coffee on-chain.

We are not replacing Venmo.

That was never the point.

What is emerging instead is far more consequential. Bitcoin is becoming the world’s neutral collateral layer.

For generations, U.S. Treasuries served as the pristine collateral of the global system. They were assumed to be safe, liquid, and unquestionable. But the world has changed. In a fractured geopolitical environment, anything with an issuer is also a liability. If there is a flag, a boardroom, or a central bank behind it, it can be pressured, frozen, sanctioned, or diluted.

By 2026, markets have begun pricing in a new premium. Not just inflation resistance, but with no issuing authority. Bitcoin has no CEO to call. No office to raid. No central authority to threaten.

It is politically deaf. That feature is no longer abstract. It is strategic.

This is why the Bitcoin conversation inside corporations has shifted. It is no longer a marketing flex or a speculative bet. It has become a policy decision. CFOs are not asking whether crypto is risky. They are asking how much counterparty risk they are carrying by holding only sovereign liabilities.

The question has changed. What percentage of surplus capital belongs in a neutral, bearer, non-sovereign asset. That is a balance sheet question, not a Twitter debate.

This shift has quietly restructured the market itself. The marginal buyer is no longer a day trader chasing candles. It is a model portfolio. A retirement plan. A registered investment advisor rebalancing a mandated allocation. ETF flows are no longer headlines. They are plumbing. This was the massive shift that 2025 brought and 2026 will solidify.

Volatility still exists, but the response has changed.

Dips are increasingly met by automated buy orders, not panic. Not emotion. Just discipline. The kind of discipline that comes from long-term mandates, not short-term conviction.

And with that, something even deeper has changed. Language.

People no longer say, “I own some bitcoin.”

They say, “I have an allocation.”

That may sound subtle, but it is seismic.

It is the difference between a lottery ticket and a pension. Between a trade you exit and a foundation you build upon. Bitcoin is becoming boring, and that is its greatest victory.

Scripture teaches us that foundations matter more than finishes. Jesus did not praise the house built quickly. He praised the one built on rock. Slow. Intentional. Storm-tested. This is not accidental.

The Holy Spirit often works this way. Quietly reordering instincts before outcomes change. Shifting posture before provision. Teaching stewardship before abundance.

Bitcoin is no longer competing with spending apps. It is competing with treasuries, collateral frameworks, and reserve assets. It is not asking to be used. It is being trusted.

From a Kingdom lens, this matters deeply.

Neutral money restrains abuse.

Bearer assets restore responsibility.

Issuer-free systems reduce coercion.

These are not just financial traits. They are moral ones.

We are watching a rebalancing not just of portfolios, but of power. Away from centralized control and toward verifiable truth. Away from promises and toward rules.

Bitcoin is not replacing God.

It is exposing idols.

And in doing so, it is finding its place. Not as a trade. Not as a fad. But as a quiet, immovable line item on the global balance sheet.

Foundations are being laid.

Prayer 🙏🌍📖

Father God, You are the builder of foundations and the author of order.

We ask for wisdom as systems shift and instincts are retrained. Teach us to steward resources with patience, discipline, and truth. Guard us from chasing excitement and anchor us in what endures.

Holy Spirit, refine our discernment.

Jesus, be the cornerstone beneath every structure we build.

And may what is being established now serve generations to come.

We trust You with the reordering.

In Jesus’ name, Amen. 🙏✝️🔥